You are here:Bean Cup Coffee > markets

Bitcoin Price Prediction Next 7 Days: What to Expect in the Cryptocurrency Market

Bean Cup Coffee2024-09-21 16:18:44【markets】7people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Introduction:Bitcoin, the world's first decentralized cryptocurrency, has been a topic of interest f airdrop,dex,cex,markets,trade value chart,buy,Introduction:Bitcoin, the world's first decentralized cryptocurrency, has been a topic of interest f

Introduction:

Bitcoin, the world's first decentralized cryptocurrency, has been a topic of interest for investors and enthusiasts alike. With its volatile nature, predicting the price of Bitcoin in the next 7 days can be a challenging task. However, by analyzing various factors and trends, we can provide a reasonable prediction for the upcoming week. In this article, we will discuss the potential price movements of Bitcoin in the next 7 days.

1. Market Trends:

The Bitcoin market has been experiencing a period of consolidation after a significant rally in 2020. The current trend suggests that Bitcoin is likely to continue its upward trajectory in the short term. However, it is important to note that the cryptocurrency market is highly unpredictable, and sudden shifts can occur at any time.

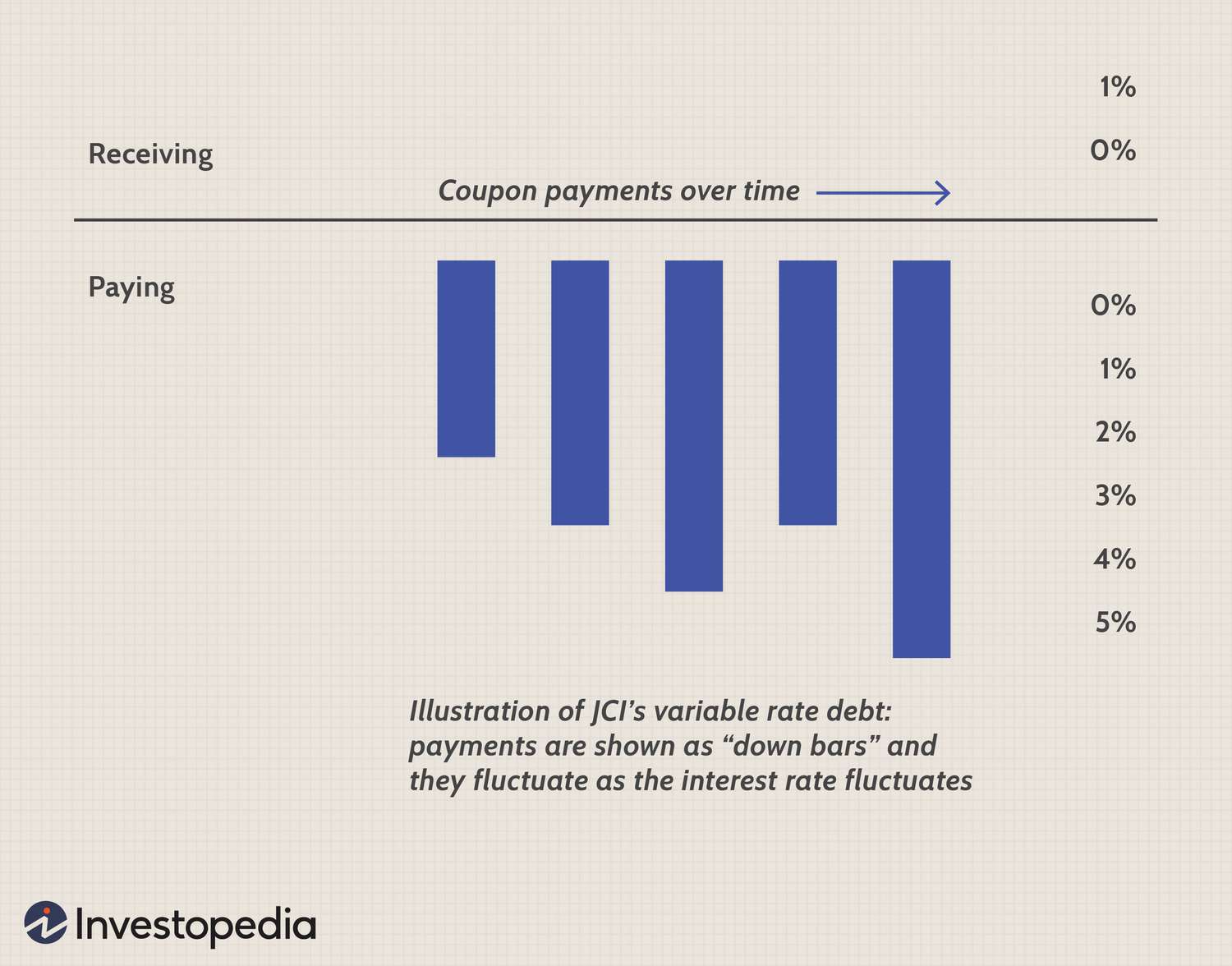

2. Technical Analysis:

Technical analysis involves studying historical price charts and using various indicators to predict future price movements. Based on the current technical indicators, Bitcoin is expected to see a slight increase in its price in the next 7 days. Some of the key indicators to consider include:

- RSI (Relative Strength Index): The RSI is currently above 50, indicating that Bitcoin is in a bullish trend.

- MACD (Moving Average Convergence Divergence): The MACD is showing a bullish crossover, suggesting that Bitcoin may continue to rise.

- Bollinger Bands: The Bollinger Bands are expanding, indicating increased volatility in the market.

3. Fundamental Analysis:

Fundamental analysis involves evaluating the underlying factors that affect the value of Bitcoin. Here are some key factors to consider:

- Adoption: The increasing adoption of Bitcoin by both retail and institutional investors is likely to drive its price higher in the short term.

- Regulatory Environment: The regulatory landscape for cryptocurrencies is still evolving. Positive news regarding regulatory clarity can boost Bitcoin's price.

- Market Sentiment: Market sentiment plays a crucial role in the cryptocurrency market. Positive news, such as increased institutional interest, can lead to higher prices.

4. Bitcoin Price Prediction Next 7 Days:

Based on the above analysis, here is a potential price prediction for Bitcoin in the next 7 days:

- Short-term Prediction: Bitcoin is expected to see a slight increase in its price, potentially reaching $40,000 to $42,000 within the next week.

- Medium-term Prediction: If the current trends continue, Bitcoin may reach $45,000 to $50,000 in the next few months.

5. Risks and Considerations:

It is important to note that the cryptocurrency market is highly volatile, and predictions are subject to change. Here are some risks and considerations to keep in mind:

- Market Volatility: The cryptocurrency market can experience sudden price swings, which may lead to significant gains or losses.

- Regulatory Risks: Changes in the regulatory landscape can impact the value of Bitcoin.

- Technological Risks: Issues with the Bitcoin network or technological advancements in the cryptocurrency space can affect its price.

Conclusion:

Predicting the price of Bitcoin in the next 7 days is a challenging task, but by analyzing market trends, technical indicators, and fundamental factors, we can provide a reasonable prediction. Based on the current analysis, Bitcoin is expected to see a slight increase in its price in the short term. However, it is crucial to keep in mind the risks and uncertainties associated with the cryptocurrency market.

This article address:https://www.nutcupcoffee.com/btc/03d59499402.html

Like!(72)

Related Posts

- Which Bitcoin Wallet Is Available in Egypt: A Comprehensive Guide

- How to Buy Crypto on Binance: A Comprehensive Guide

- Is Mining Bitcoins Legal?

- How to Buy Crypto on Binance: A Comprehensive Guide

- How to Send BNB from Binance to Trust Wallet: A Step-by-Step Guide

- Bitcoin Interest Price Mining: A Game-Changing Concept in Cryptocurrency

- Binance BNB to BNB Smart Chain: A Comprehensive Guide

- What if My State is Not Listed with Binance?

- Best Bitcoin Mining App 2017: A Comprehensive Review

- What if My State is Not Listed with Binance?

Popular

Recent

How Much is 1 Bitcoin Cash in Naira?

How to Turn Bitcoin into Cash Without the Government Knowing

How to Buy in Bitcoin Cash: A Comprehensive Guide

Bitcoin Cash Price Live in INR: A Comprehensive Analysis

Is Bitcoin Gold Wallet Safe: A Comprehensive Guide

What if My State is Not Listed with Binance?

How to Keep Bitcoin Cash Safe: A Comprehensive Guide

The Price of a Bitcoin Chart: A Journey Through the Volatile Cryptocurrency Market

links

- Bitcoin Price Rising: A Comprehensive Analysis

- What Binance Coin Should I Buy: A Comprehensive Guide

- Buy Holochain Binance: A Comprehensive Guide to Purchasing Holochain on Binance

- **Understanding the Gift Card Binance USDT: A Comprehensive Guide

- Safepal Wallet Binance: The Ultimate Cryptocurrency Solution

- Bitcoin Best Wallets: How to Safely Store Your Cryptocurrency

- Can I Mine Bitcoin on My PC in 2017?

- What Binance Coin Should I Buy: A Comprehensive Guide

- Binance ERC20 Wallet Address: A Comprehensive Guide

- Bitcoin Mining Calculator 2017: A Comprehensive Guide to Estimating Your Profits